Fostering end-to-end adaptation in the financial sector

ClimateCharted operates at the centre of the climate change adaptation Eco-system to support banks and insurers in seizing business opportunities connected to climate resilience.

We put a figure on natural hazards through cutting-edge climate intelligence to help insurers and banks design new resilience-oriented products, maintain competitive advantage in climate-vulnerable areas and comply with the EU Taxonomy and supervisory risk management requirements.

The ClimateCharted platform connects the financial sector with an Ecosystem of manufacturers, contractors and disaster restoration companies to effectively prevent and reduce climate risk in their portfolios.

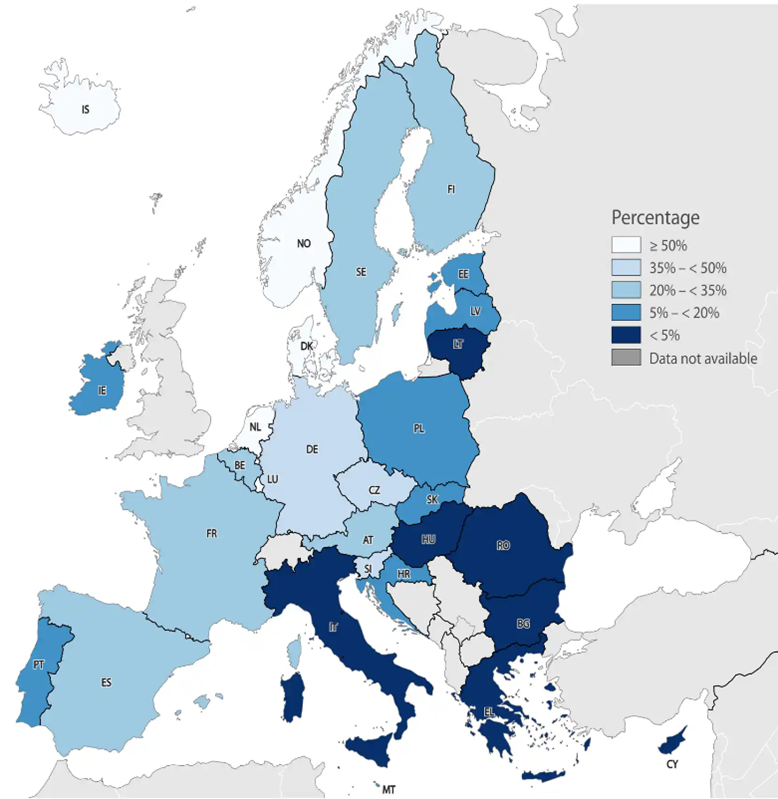

(1980-2021, percentages) Average share of insured economic losses caused by weather-related events in Europe (ECB,

EIOPA, 2023, Policy options to reduce the climate insurance protection gap; Discussion

Paper)

(1980-2021, percentages) Average share of insured economic losses caused by weather-related events in Europe (ECB,

EIOPA, 2023, Policy options to reduce the climate insurance protection gap; Discussion

Paper)

Our mission

ClimateCharted aims at narrowing the Climate Insurance Protection Gap and promoting societal resilience to a changing climate by connecting relevant actors in the adaptation Ecosystem

In the first half of 2023, the overall economic losses from natural catastrophes amounted to USD 120 billion (Swiss Re). About 75% of climate-related losses are uninsured in EU, with peaks of 95% in countries such as Italy and Greece (ECB, 2023).

ClimateCharted Platform

ClimateCharted provides banks and insurance companies with our flagship easy-to-use web-based platform to be accessed in the quote phase of a new mortgage or home insurance policy.

The platform evaluates climate vulnerability of the building or activity in near-real-time based on few basic pieces of information and provides the institution and the client with an accessible report which includes:

Expected annual damage connected to natural hazards in a 30-year horizon

Customised risk reduction «solutions» measures to mitigate the damages identified

An Eco-system of adaptation partners who can implement the risk reduction solutions.

Lending and insurance solutions targeting climate resilience (customised based on available product offering)

CLIMATECHARTED, BEYOND A PLATFORM.

OUR OFFERINGS AND SERVICES:

NEW BUSINESS ON ADAPTATION

Design new commercial products (e.g. loans for resilient homes, Taxonomy-aligned home policies) or review existing ones

TRACK YOUR EFFORT

Monitor the success of the climate resilience commercial campaigns through our business intelligence tool

ENGAGE WITH YOUR LOCAL BRANCHES

-Train your distribution channel on the functionalities and commercial opportunities connected to the use of the software

PROVIDE FOR THE DATA YOU NEED

Set-up near-real-time data custom flows to enrich your internal IT systems and allow your central functions to monitor overall portfolio climate vulnerability.

REPORTING

Establish information flows for your climate reporting and disclosures

DEFINE YOUR ADAPTATION STRATEGY

Review your climate strategy and your risk appetite including climate change adaptation targets

WE DELIVER REAL ADVANTAGES

BE THE LEADER OF THE NEW ADAPTATION MARKET

Seize new business opportunities connected to resilience lending and impact underwriting.

DON’T TURN AWAY FROM HIGH-RISK AREAS

Continue to do business in areas prone to natural hazards.

COMPLIANT BY DESIGN

Comply with the latest EU Regulation (EU Taxonomy, CSRD).

BETTER CLIMATE RISK MANAGEMENT

Reduce overall portfolio climate risk and enrich risk managment databases with asset-level vulnerability and adaptation data, ensuring alignment with supervisory expectations.

BE AN ADAPTATION CONSULTANT

Support your local costumers in understanding climate risks and navigating the adaptation journey.

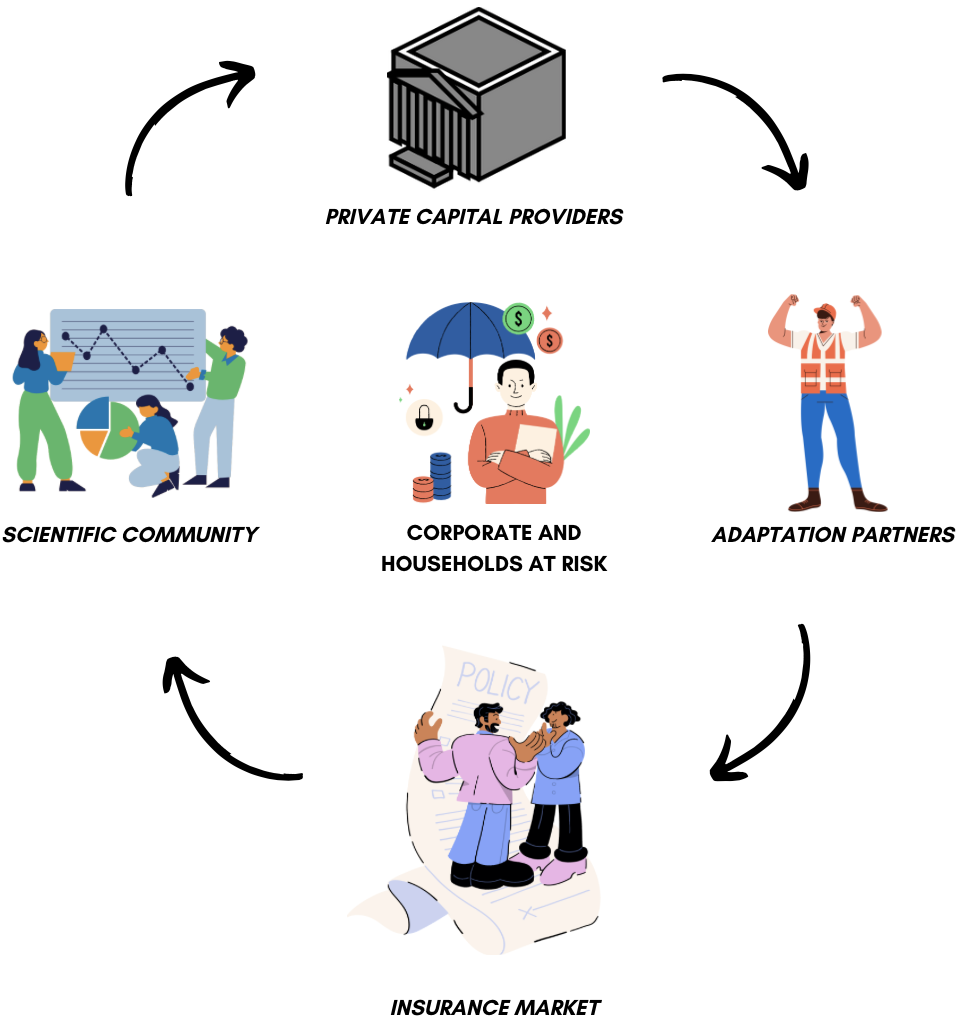

CLIMATECHARTED ECOSYSTEM

Narrowing the Climate Protection Gap is no easy task. Collaboration between banks, insurers, research and real economy actors is crucial to build climate resilience.

SCIENTIFIC COMMUNITY

Researchers, scientists, engineers can evaluate the long-term vulnerability of assets and activities to a changing climate.

PRIVATE CAPITAL PROVIDERS

Banks and investors can channel financial flows to vulnerable households and businesses to build resilience

ADAPTATION PARTNERS

Real economy actors, such as contractors, manufacturers, property restoration firms can provide hands-on support to future-proof assets and business activities

INSURANCE MARKET

Insurers and reinsurers are equipped to carry the residual climate risk and provide prompt financial aid in case of natural catastrophes.

For this purpose, we created an Ecosystem of adaptation partners, which includes manufacturers of climate resilience solutions, contractors and property restoration firms.